One of my favorite moments of each year’s NFL and NBA Draft’s are when the commissioner hits the stage and announces the following words – “We have a Trade”. The second that message is communicated to the audience, everyone starts freaking out. Some get visibly upset, and others start cheering without having any idea what’s actually transpired.

The questions then start circulating. Who’s being dealt? What are they getting back? Is it a superstar player from another team? How will this impact my team and the rest of the league?

It’s quite comical watching people immediately overreact, and often what follows is nothing significant or a move which can’t even be judged s a success or failure for the next two or three years. But in this instant gratification society that we live in this is how things go.

It’s no different in the world of radio. Let’s rewind to three weeks ago when the biggest story in radio hit the trades – “Entercom and CBS have announced a merger”.

Right after the news broke, there were folks on social media assuming the worst and talking on the floor at radio row about the likelihood of needing to find a new job. Rather than absorbing the information, researching the company, and talking to others about what to expect, it became a classic case of “the sky is falling and we’re all doomed”.

If you’ve seen the movie “Captain Phillips” then you’ll likely remember the numerous instances when Barkhad Abdi tells Tom Hanks “Relax Irish. Everything is going to be ok”. And that’s exactly my message to you if you work in this industry, especially if you’re involved with a sports radio brand which now falls under Entercom’s watch.

It’s understandable to question where one fits into the big picture of a new company’s plan, but there is something called due process. People foolishly assume that they’ll go to work the next day and find the grim reaper lingering outside of their cubicle or studio, rather than focusing their time and energies on the tasks at hand. If you concentrate on generating results and revenue, and limit the noise, drama, and distractions around you, you’ll often find your job stability isn’t in question, even during times of change.

As it pertains to this specific situation, the first thing to point out is that a merger takes a while to complete. This isn’t a case where the news gets announced and the following day the new company dives into action and chops off the heads of 1000 employees.

Secondly, if a company is going to invest nearly two billion dollars (stock still counts) in taking over an organization, they’re doing so because they see value in it. Companies usually retain the majority of those who perform well and help the company’s bottom line.

Third, while the immediate reaction of employees is to scrutinize the new company acquiring them, they lose sight of the message being relayed by their previous employer. In this case it was loud and clear, CBS did not believe radio was important to their future.

For decades CBS has been an excellent company, one of the best in radio broadcasting. But their priorities and interests changed. A loyal employee is entitled to feel saddened by the reality that the organization they gave years of their life to is going in a new direction, but while they reminisce about the god old days and assume the worst of what’s ahead, they lose sight of the bigger message. In this case it was cut and dry, CBS didn’t want to be part of their radio future, Entercom did.

For decades CBS has been an excellent company, one of the best in radio broadcasting. But their priorities and interests changed. A loyal employee is entitled to feel saddened by the reality that the organization they gave years of their life to is going in a new direction, but while they reminisce about the god old days and assume the worst of what’s ahead, they lose sight of the bigger message. In this case it was cut and dry, CBS didn’t want to be part of their radio future, Entercom did.

I don’t have access to the thoughts that run thru Les Moonves’ mind, but if he felt CBS’ growth potential was stronger by breaking away from radio, and turning the business over to Entercom, there’s nothing wrong with that. It’s a business decision, plain and simple, and CBS will be just fine as a company without radio.

I just never understood why the group making the investment becomes the one placed under fire and the one selling off is seen as the darling of the transaction. It’s likely due to the concerns of consolidation taking place in the future, but as I said earlier, performers often are retained, and if not, other broadcast groups will be in hot pursuit of an individual’s services if they feel they can make money with them.

So how does this impact the future of sports radio? I think it couldn’t possibly be better.

No disrespect to Cumulus or iHeart, but aside from CBS, Entercom has been one of the best at operating the sports radio format. In most cases they employ a live and local strategy on their stations and carry local play by play rights. That approach has placed them either in the driver’s seat or in striking distance of the top spot in numerous markets.

No disrespect to Cumulus or iHeart, but aside from CBS, Entercom has been one of the best at operating the sports radio format. In most cases they employ a live and local strategy on their stations and carry local play by play rights. That approach has placed them either in the driver’s seat or in striking distance of the top spot in numerous markets.

The reason Entercom is a significant player in the format is because CEO David Field, COO Weezie Kramer, and President of Programming Pat Paxton have a strong passion for it. They believe in the programming, the way it connects with targeted audiences, and understand the attraction it has to advertisers. They also recognize the power of play by play and are always at the table negotiating when opportunities arise to help their local sports radio brands.

Having had the benefit of working for them, I can tell you that they get involved with local leadership to help each brand prosper. I especially valued and appreciated how they gave their leaders a voice in the room, and were willing to make additional investments and support decisions that they may have been on the fence about if the acting PD and/or GM could make a strong case for it. I don’t know many companies who’s CEO takes the time during a market visit to personally sit down with a programmer and seek their input in trying to make a radio station better, but that’s what you get with David Field.

Once the merger is completed, Entercom will become the dominant force in sports radio programming. They will oversee the biggest local brands in the format, plus assume control of the CBS Sports Radio Network. The company could choose to give the network a much needed jolt to become a bigger national player or if they feel the network’s upside is limited they could elect to focus those resources in other areas.

If you look back at the company’s 2016 performance, Entercom was up in each quarter. Their stock price also grew from $11.23 per share on January 1, 2016 to $15.30 per share on December 31, 2016. Consider that during this same period of time, other groups were clinging to their stocks remaining listed and battling to avoid bankruptcy.

CBS during that period also remained a solid performer but once again, the company was on the record saying they wanted to exit the radio business. That isn’t a good long-term recipe for gaining confidence from advertisers, employees, business partners, and stockholders.

Although there are many positives to look at, don’t forget that this merger isn’t finalized yet. There will be more transactions completed before we know what the entire big picture for the company looks like. Entercom will have a few markets where they’ll be over the limit of how many stations they can own and operate, which means they’ll have to either sell or trade off some of those stations. They’ll also have to decide during the process which brands they want to retain and which ones they’ll part with.

Case in point, in Boston, the company will have two of the most dominant sports stations in the country, WEEI and 98.5 The Sports Hub. Collectively they reach 25% of the male demo in the market. The first reaction from many was “they can’t possibly operate both sports radio brands”. My response, “why not”?

Nobody bats an eye when a company has two music stations or news/talk stations, so why is it not possible to operate two dominant sports brands? If the stations are generating revenue and ratings, and possess the radio rights to every professional and collegiate sports team in the market, why wouldn’t that be attractive to hold on to?

I have no idea if that will wind up being the case or not, and the same questions will come up in Miami and Sacramento where they now have two sports radio stations, but from where I sit, that’s a great problem for Entercom to have.

To paint a picture of where the company will sit in the sports radio space after this merger, assuming no additional sports stations get added to their portfolio, check this out.

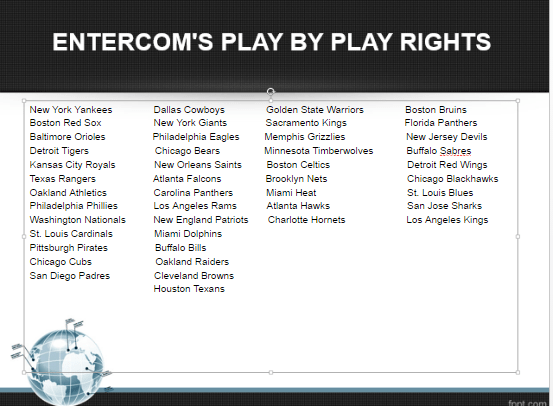

The company also operates a few other AM sports talkers which primarily feature network programming, and as impressive as all of these brands and markets are, now add the following list of play by play partnerships below into the mix.

That’s a total of 45 play by play partnerships, and that doesn’t include college sports. The company also has some of those relationships too, including the rights to some prestigious schools such as North Carolina, Michigan, Miami, Kansas, LSU and a few others.

Depending on the language in each contract, some teams may have an opportunity to pull their rights from their current radio stations, and re-open the local bidding due to the merger. Given though the company’s increased power in the sports format, and its commitment to doing business with professional sports teams, I’d expect most franchises will want to remain in their current situations, especially if local business is strong.

When you analyze the way the company looks on paper, assuming the merger goes thru without any drastic changes, it is extremely impressive, and puts Entercom at the top of the sports radio empire. If you’re a market manager, host, producer, programmer, sales manager, account executive or imaging director with a passion for sports radio, this becomes the company you want to work for. If you’re an advertiser, there isn’t a group with more attractive sports assets, markets and brands who can put your message in front of the right audience on a local and national scale.

Only time will tell how it all plays out, but for the health of the sports format, and for the radio business as a whole, I think this is wonderful news. I don’t often say that when one radio company expands, and another is eliminated, but my personal history with Entercom gives me great confidence that they’ll execute in superb fashion.

Now it’s up to the company’s leaders, and every employee entering the workplace to deliver results, and use the momentum of this merger to help sports radio gain a much bigger piece of the pie. I look forward to seeing how it all comes together over the next few years.

Jason Barrett is the President and Founder of Barrett Media since the company was created in September 2015. Prior to its arrival, JB served as a sports radio programmer, launching brands such as 95.7 The Game in San Francisco, and 101 ESPN in St. Louis. He also spent time programming SportsTalk 950 in Philadelphia, 590 The Fan KFNS in St. Louis, and ESPN 1340/1390 in Poughkeepsie, NY. Jason also worked on-air and behind the scenes in local radio at 101.5 WPDH, WTBQ 1110AM, and WPYX 106.5. He also spent two years on the national stage, producing radio shows for ESPN Radio in Bristol, CT. Among them included the Dan Patrick Show, and GameNight.

You can find JB on Twitter @SportsRadioPD. He’s also reachable by email at Jason@BarrettMedia.com.