Earlier in the month, The Walt Disney Company agreed to a merger in which it would combine its Hulu + Live TV service with Fubo operations in a joint venture. Disney will be slated to own 70% of this venture, and the combined businesses would operate under the Fubo company name while the streaming services remain separate in sales and marketing. At the same time, Fubo agreed to drop its antitrust lawsuit to block the launch of Venu Sports, the joint streaming venture from Disney, FOX Corporation and Warner Bros. Discovery. Yet days after this announcement, DirecTV and EchoStar filed briefs to the court and signaled potential interest in litigation, and Venu Sports was shuttered for good shortly thereafter.

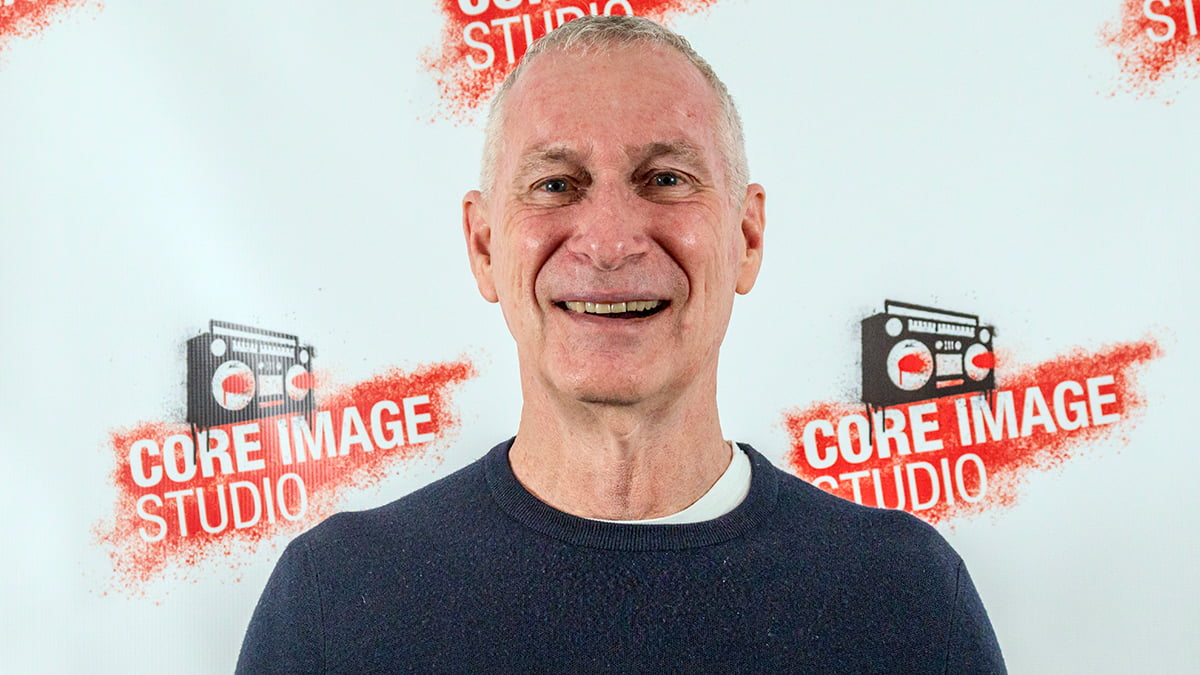

John Skipper, the former president of ESPN, had been skeptical that Venu Sports would be successful in the marketplace from the time it was announced last February. On the latest edition of The Sporting Class, David Samson reminded listeners that Skipper believed that Venu Sports represented a ridiculous announcement and did not offer anything new. Upon explaining the situation, Skipper elaborated on his thoughts surrounding the now-defunct streaming endeavor from his vantage point.

“They don’t need it now, right?,” Skipper said. “It was always a temporary stopgap before [ESPN] launched Flagship…. This was always a Disney-led effort in my opinion. I thought that Disney always got the preponderance of benefit.”

DirecTV recently announced a new skinny bundle of sports channels, titled “MySports,” that includes networks and broadcast entities available in 24 metropolitan areas. The plan is launching with distribution rights from the three media conglomerates involved in Venu Sports, along with Comcast-owned NBCUniversal. The bundle will also add regional sports networks later in the year, granting a broad array of local and national coverage. Skipper presumed that EchoStar, the parent company of Dish Network, will also receive the same package and that consumers no longer need Venu Sports. DirecTV previously tried to acquire Dish Network, but the talks were halted last November after being unable to reach a deal.

“My view is they wanted to give the consumer another mirage of a choice of efficiency, and that is what these companies are trying to give consumers time and time again,” Samson said. “After they started cutting the cord, they want to be savior, except really all they’re doing is making you pay the same or more, but to different platforms.”

Torre acknowledged that Venu Sports was a thought when Skipper was the president of ESPN, but it has turned into a priority amid a media landscape moving towards digital distribution amid cord cutting. Skipper followed up by saying that the longer Flagship waits to launch, which is reportedly expected to occur this fall, the more there will be leakage of live sports rights. More companies are becoming involved in the sports media space, such as Netflix, which recently broadcast an NFL Christmas Day doubleheader, commenced a deal with WWE for Raw and landed U.S. rights for the FIFA Women’s World Cup tournaments in 2027 and 2031.

“ESPN is still going to have more rights than anybody else for a long, long time, so they have managed to be smart and prevail, but I think Flagship in some way is less and less attractive because there’s less and less that’s not on there,” Skipper explained. “There’s stuff on Paramount and there’s stuff on Max and there’s stuff on TNT, and you’re still going to have to – I guess if you buy Flagship, the question is what you get from Flagship that you don’t get from MySports.”

One area surrounding the Flagship launch Skipper believes ESPN has not provided much detail is what would set it apart for the consumer as other bundles offer sports networks. Samson also expressed concern that ESPN would one day consider taking everything off of its linear television network to drive subscriptions, something Skipper does not think will happen. Nonetheless, he remains skeptical about the value propositions of features and personalization in getting people to subscribe to the service.

“Remember how many times people have talked about, ‘Oh, you’re going to get to pick your own camera angles,’?,” Skipper said. “Nobody wants to. Even the ManningCast, which by the way I watch Monday night instead of the regular feed – quite fun, quite fun – most people don’t watch it… and if you add the two together, they’re probably not getting new people.”

Barrett Media produces daily content on the music, news, and sports media industries. To stay updated, sign up for our newsletters and get the latest information delivered straight to your inbox.