Conducting research is a critical part of every brand’s strategy and development. It’s not an easy process and not every piece of feedback is informative, but it’s necessary in helping your company and people avoid danger signs and pursue opportunities to enjoy greater success. Throughout my career, I’ve used ratings results, focus groups, social media responses, and digital analytics to help my brands build momentum and steer clear of landmines. The radio host and programmer’s responsibility is to know what moves and interests the audience. That information then allows you to design your product strategy to generate larger ratings, deeper brand loyalty, and revenue.

I compare it to being in a popular band. Fans buy tickets to see you perform. When they attend your concert, they expect you to play the songs they enjoy most and do things which are consistent with the way you’ve represented yourself throughout the years. If you hit the stage and act differently and showcase material that you love but the audience isn’t familiar with it will have a negative impact on your future ability to sell tickets, music, and merchandise.

The downside of research is that certain traits have more or less importance from individual to individual. Listeners may tell you that they want to hear a heavy dose of NFL content on your airwaves during their morning commute, and your hosts may provide it, yet not move the needle in the ratings. What does that tell you? It can mean many things. It could be that your talent doesn’t possess the ability to present the content in a spectacular way. It can mean that your competitor has an established show which your audience won’t break their loyalty to. Or it can be an issue with the meters in your market or something else. This is why researching your audience regularly is necessary. The longer you do it, the better read you’re able to get on multiple situations.

Since it’s been a while since I last analyzed the listening habits and interests of sports radio listeners, I thought I’d take a crack at it to see if people’s tastes had changed. I was blown away by the response of 2,006 participants. I have many of my friends in the industry to thank for getting listeners involved. Although a few responses didn’t jive with other projects I’ve worked on, I did find that the majority of responses offered valuable information that we can learn from.

When you look at the feedback below, keep in mind, these responses are coming from sports radio fans all across the United States and Canada. If this exercise were done in an individual market the results would likely be different. But there are some trends which would be consistent anywhere you listen.

Altogether I asked nine questions in this survey, and my goal was to find out which answers the audience identified with MOST. I stress the word “most” because a number of people reached out on social media expressing a frustration with not being able to provide multiple answers. In most case studies, it’s understood that fans of a product will like multiple things. But what brands want to know, is which items make the biggest difference? That was my goal too with this survey.

I will now share with you the results of the BSM sports radio research survey. You’ll find my analysis under each question, highlighting what I felt was most important to take away. Enjoy!

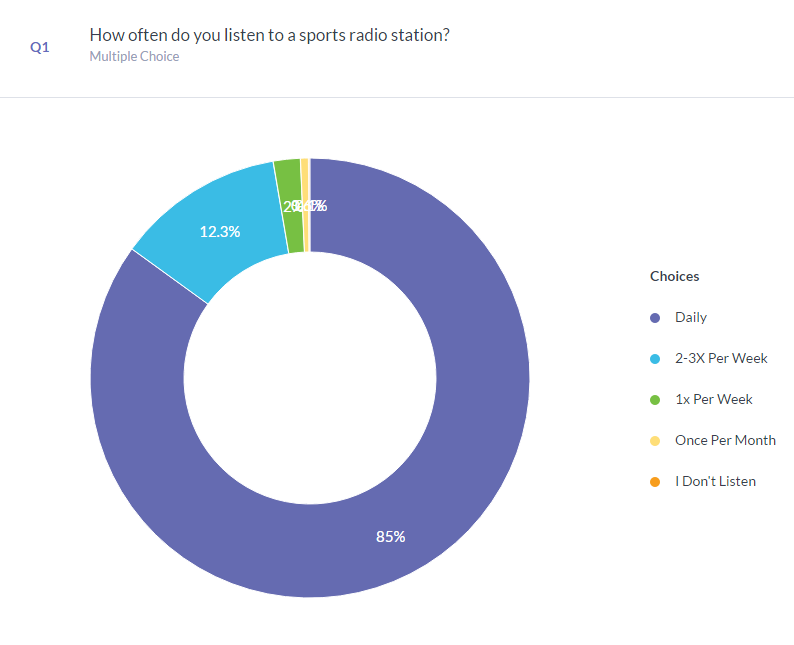

BSM: The majority of fans who took this survey are hardcore sports radio listeners. 85% or 1,700+ said they listen daily which is great news if you’re in the industry. However, if you look at most radio markets and the ratings that support each brand, most don’t have 85% of their listeners tuning in daily. Those who listen 2-3X per week are also higher than 12% in most cases.

BSM: For all of the talk about the growing power of the phone, it’s good to see that the car is where listeners still listen to sports radio the most. The phone does come in second with 1 out of 5 listeners tuning in. When you combine that number with the percentage of listeners who listen on a computer, laptop or ipad, the total grows to 30.5%. Why is that important? Because if your website or app delivers a poor listening experience, is difficult to navigate, or features outdated content, 3 out of every 10 listeners are going to notice. You can’t just program your radio station. You must treat your digital brands with great care too.

I did find it interesting that listening at home or at work came in at 11.4%. When that number is combined with listening in the car, you have 68% of hardcore sports radio listeners who are tuned in through an actual radio, not a digital device. That surprised me. We can expect more listening in the future to the sports format to be done on the phone and less on a radio. If we analyzed all formats in the radio industry instead of focusing just on the sports format, this would be a close call between the two primary options.

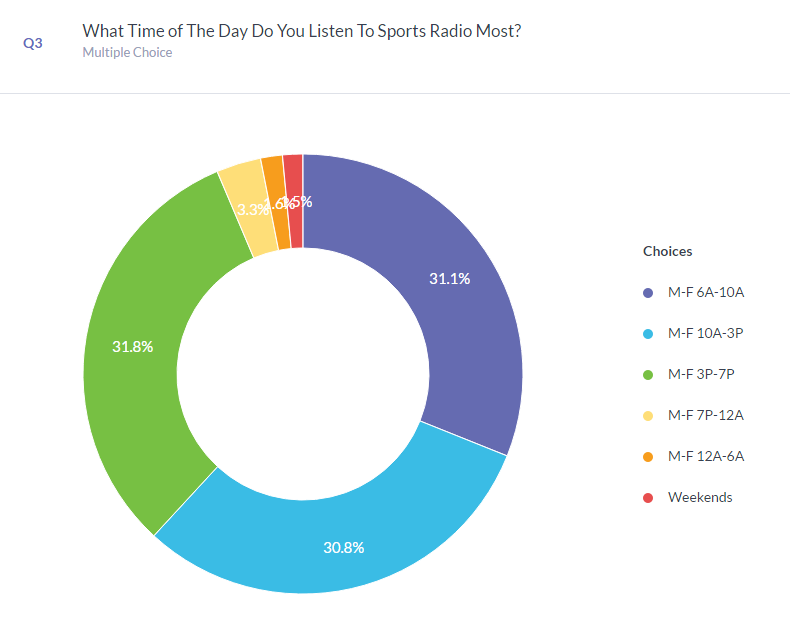

BSM: If you judge listening habits based on the ratings data many radio stations receive, you’d be convinced that few people exist during the hours of 10a-3p, and everyone listens to sports radio programming during the morning or afternoon commute. I’m not sure if this is a case of hardcore sports radio fans having a different routine but I was surprised to see middays produce such a healthy number. In comparing mornings, middays, and afternoons they were extremely close but PM drive held a slight advantage. Nights, overnights, and weekends were much lower which is consistent with what many stations experience across the country.

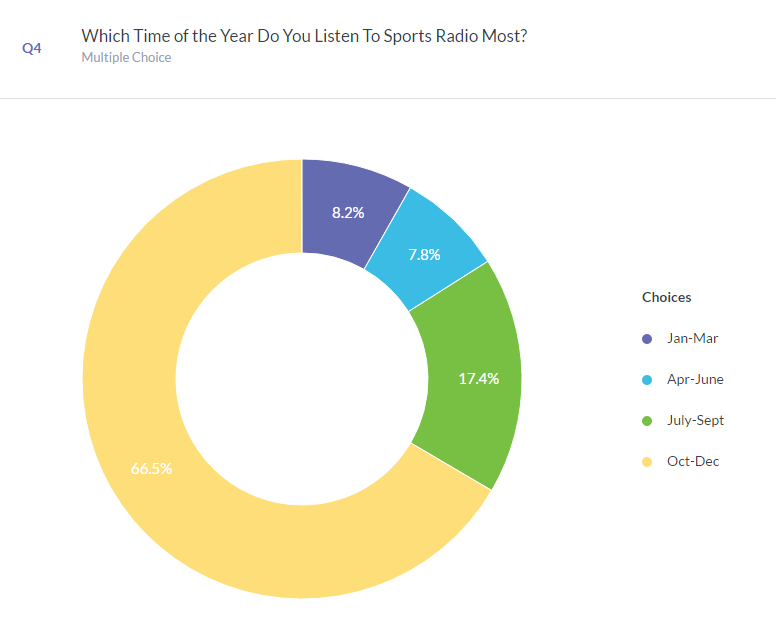

BSM: No surprise here. Fall is the most important time of the year for the sports format and that’s reflected with almost 84% of listening being most likely between the months of July and December. This is why so many brands air football games and position their Monday’s and Friday’s around football programming. It’s also why each fall you hear a heavy amount of football related guests on local stations during the course of the week. The big challenge for brands moving forward is to figure out how to get those individuals back to the dial between the months of January and June.

BSM: This was my favorite part of the survey because it gave a good look into the different things listeners hear daily and what moves the needle most with them. The #1 takeaway was that people want to hear a host deliver strong opinion and allow room for debate. I’ve often said drama is what fuels listening to sports radio, and when coupled with opinion and disagreement it becomes a recipe for success.

The second most popular item was funny stories and bits. This means the top two things a host can deliver on a daily basis to engage an audience are passionate opinion and humor.

Coming in third were interviews. Although I enjoy them and believe they can help a brand create or extend content and generate additional buzz, they are not more important than what the host has to say. Many stations also make the mistake of keeping them on for a long period of time, which is why listeners lose interest.

The last item to highlight is the lack of interest in hearing callers. I’ve heard this same story in multiple markets I’ve worked in. Only 5% of people in this survey listed the callers as their favorite part of a sports radio show. If you think your show is connecting based on how many times you’ve seen the phone line light up you’re missing the boat. Calls represent a small fraction of your audience. Although a good passionate call can add entertainment value, and elicit good response from a host, a great on-air talent can perform without them and still kick ass in the ratings.

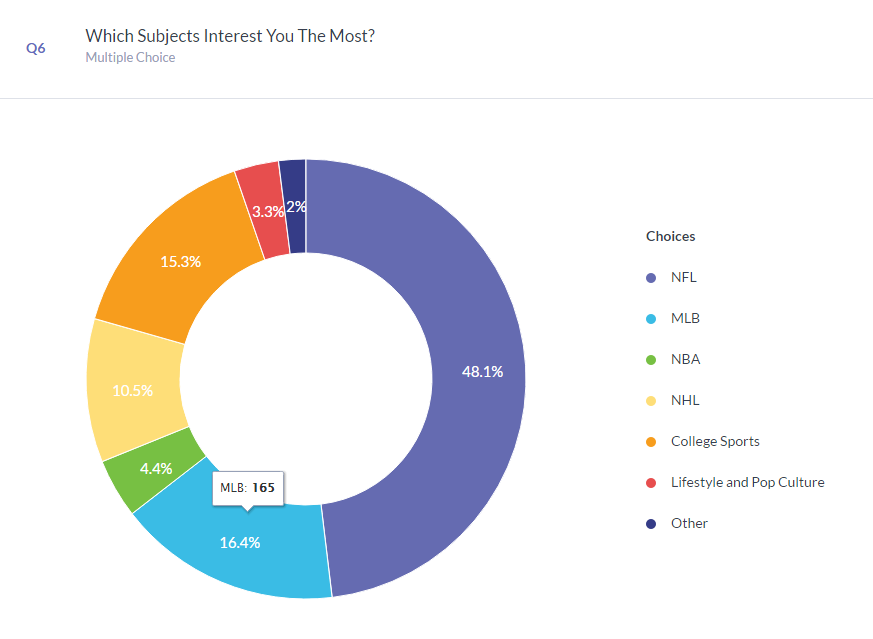

BSM: It’s an NFL world that we’re living in, and the survey results confirm that yet again. 1 out of every 2 listeners wants it, and the reason why your audience spikes between July and December is because the NFL becomes the main attraction. This should be no surprise. If you’re not finding a way each day to discuss your local team AND other key storylines from the National Football League, you’re allowing an opportunity to connect with your audience get away.

I’ll admit that I was surprised to see MLB and College Sports so close, because baseball simply has a longer amount of time to be a featured part of the daily conversation. If we did this survey in April I wonder if MLB would be higher. That said, the appetite for College Football and Basketball is strong, and growing, and that’s excellent news for brands who enter the fall seeking a big lift.

The one area that stood out negatively was how poorly the NBA was received in this survey. Once again, depending on your market it’s either a hot or cold conversation, but for the purposes of this survey it’s behind the NFL, MLB and College Sports, and even the NHL. Having worked in multiple NHL markets I can tell you that this evidence doesn’t jive with what I’ve seen in previous research studies. Usually the NHL is beaten 4-5 to 1 by the NBA. But the geography of the individuals taking the survey or the time of the year when we’re conducting this survey could have factored into the final totals.

Something important to remember for all air talent and programmers. You may think your show can afford to spend 2-3 segments per day focusing on lesser stuff because the majority of it deals with the important topics, but those 2-3 segments where you discuss lesser subjects (in this case the NBA and NHL), could be the difference in winning or losing your next book. If people tell you they want NFL, MLB and College Sports content, don’t argue with them – give them what they want. That type of customer service often puts more money in your pocket.

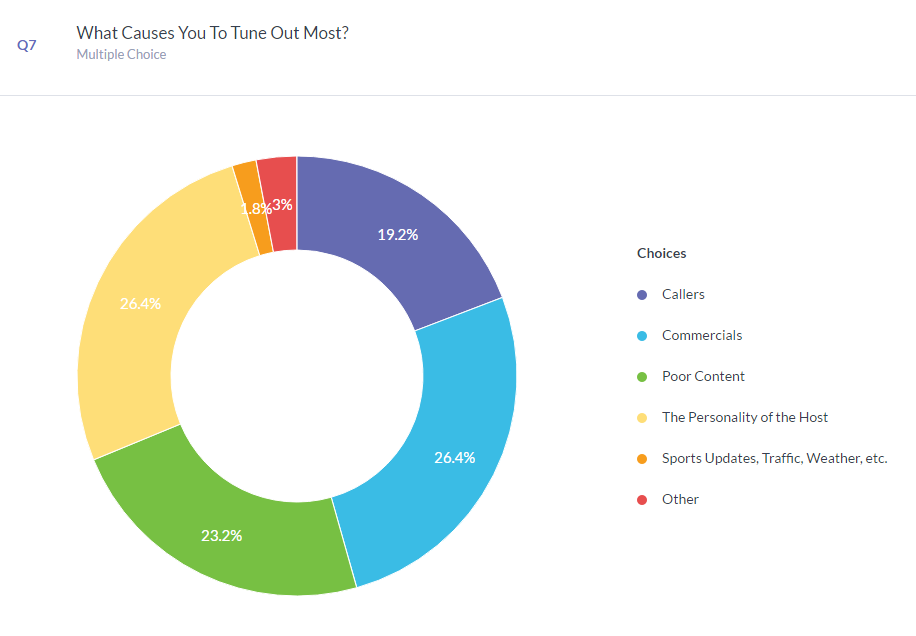

BSM: The number one reason listeners leave your radio station is not as cut and dry as you might have thought. It’s actually a tie between commercials, and the personality of a host. Face it, people hate interruptions. But they’re a part of our business. You know when every show begins that people will leave at some point when they hear a commercial. But if your personality is divisive, fake or difficult to connect with, it can be as damaging as a Kars For Kids jingle. Some hosts can’t control this, but people listen to talent they want to hang out and have a beer with. If you sound detached from the audience or dismissive of their input, they’ll make you pay for it by tuning you out.

Not far behind those two options was poor content. As I stated in the previous section, if you’re forcing 2-3 segments into the show because you enjoy them but the majority of your audience doesn’t, that’s considered poor content. It doesn’t matter how great you deliver it, if nobody cares about the subject matter.

Right behind poor content were callers at nearly 20%. That number surprised me. But if you’re wondering if hearing the audience weigh in with mindless responses is valuable to your show, remember this survey. 5% said hearing listeners call-in was their most enjoyable part of a sports radio show. 20% said they find them to be the #1 reason to tune out.

BSM: It’s clear that people prefer to listen to sports talk LIVE but if we did this survey 5 years ago, I bet it would’ve been 90-10 instead of 73-26. What this tells me is that podcasting is growing, and listening on demand has become more attractive to the audience. The interest in the content our format creates remains high but having the ability to enjoy it when it suits an individuals schedule continues to increase. What will really be interesting is to see the results to this same exact question in 2-3 years.

BSM: Many of us who have made a living in the sports format have been beaten over the head with the message – you must deliver local, local, local. That content strategy drives ratings and revenue higher than national sports programming in most markets. This survey showed that 3 out 4 people prefer local to national. That’s not a surprise. It should make every local radio operator feel good to know that local talent discussing local content still has tremendous value.

However, if you’re dismissing national sports radio programming, that would be a mistake. 1 out of 4 hardcore sports fans in this survey (500+) didn’t care if the programming was local or not. There’s plenty of room at the table for national sports radio networks like ESPN, FOX, CBS, NBC, SiriusXM and SB Nation Radio. When you add the success these national brands have on digital platforms due to their extended reach and cross promotional opportunities on television and websites, it builds an even more impressive story.

The bottom line, we can have a thriving format with both local and national sports radio. It does not have to be a case of picking one or the other.

Jason Barrett is the President and Founder of Barrett Media since the company was created in September 2015. Prior to its arrival, JB served as a sports radio programmer, launching brands such as 95.7 The Game in San Francisco, and 101 ESPN in St. Louis. He also spent time programming SportsTalk 950 in Philadelphia, 590 The Fan KFNS in St. Louis, and ESPN 1340/1390 in Poughkeepsie, NY. Jason also worked on-air and behind the scenes in local radio at 101.5 WPDH, WTBQ 1110AM, and WPYX 106.5. He also spent two years on the national stage, producing radio shows for ESPN Radio in Bristol, CT. Among them included the Dan Patrick Show, and GameNight.

You can find JB on Twitter @SportsRadioPD. He’s also reachable by email at Jason@BarrettMedia.com.