Earlier this month, Westwood One published a breathlessly worded report featuring Chief Insights Officer Pierre Bouvard’s take on Edison Research’s “Share of Ear” study. Titled “What Ever Happened to Pandora? Edison’s Q2 2024 ‘Share of Ear’ Reveals Pandora’s Stunning Collapse and the Enduring Strength of AM/FM Radio and Podcasts,” you can likely guess that the analysis picked apart Edison’s findings to tout radio’s strength amid a media landscape in upheaval.

But behind the charts, graphs, and percentages lie some seriously flawed conclusions. Bouvard’s willingness to cherry-pick certain data points and then trumpet them as a win speaks to a larger issue: Radio is still blind to its waning competitiveness. The apples-to-apples comparison of “ad-supported” platforms no longer applies in the age of subscription music services, where listeners are offered a buffet of music for the price of a couple of Starbucks drinks per month. And if we truly insist on comparing ad-supported platforms, we have to consider that the market has exponentially expanded with the global reach of radio stations thanks to the Internet and services like RadioGarden, the Broadcasts app, and Radio-Browser.info.

Let’s break down some of the claims made by WW1’s and Bouvard’s response, shall we?

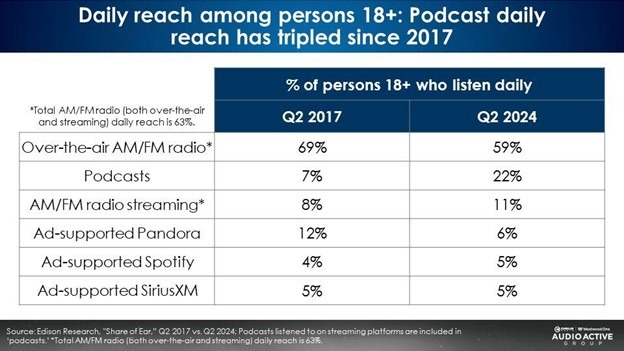

CLAIM: “AM/FM radio represents the dominant ad-supported audio platform with a 69% overall share and a massive 86% in-car share.”

COUNTERPOINT: Even by the data presented by this article, that 69% figure is seven years old – and the article shows the current, Q2 2024 reach is 59%, representing a full 10% drop since 2017. Radio’s audience share continues to erode, and the industry’s response appears to still solely be “but we’re still #1!” How much more can the AM/FM industry take before we actually go on offense?

I also question the inclusion of the ad-supported SiriusXM reach since the “Free Access” plan was just announced in August 2024, so I’m not sure where that 5% number from 2017 is coming from. And if SiriusXM already scored 5% of ad-supported listening in just a few weeks, that indicates the Free Access tier is an incredibly in-demand service that should be expected to skyrocket in the coming months and years, especially for in-car listening.

CLAIM: “Since consumer interest in Pandora Radio hit an all-time high in 2008, its audience and profile have significantly collapsed, according to Google Search trends.”

COUNTERPOINT: Using Google Search trends to track consumer interest only tells a small sliver of the story.

There’s an excellent reason why Google Search trends may have started dropping off in 2008: That was the year the Apple App Store launched. With the ability of iPhone users to simply find and establish an account through the Pandora app, Google likely stopped being the first step in the discovery process for new Pandora users; they simply looked it up in the App Store, downloaded the app and began streaming.

Statista Research shows that Pandora still has just over 46 million active monthly users as of Q4 2023. Admittedly, that’s a little more than half the number they had back in 2015, but it’s still a healthy chunk of audience share, not to mention the fact that the service pulled in US$2.09 billion in revenue in 2022, with US$1.5 billion of that coming from advertising. Not bad for a platform “in decline,” no?

Statista also says over-the-air AM/FM radio in the U.S. pulled in $11.3 billion in 2022, which means Pandora’s advertising efforts alone represented 13% of AM/FM’s total take, and that radio missed out on that piece of the overall pie. I wonder how much more AM/FM missed because those ad dollars were diverted to other services like Spotify?

CLAIM: “Perception vs. reality: Advertisers and agencies wildly overestimate Spotify and Pandora’s audiences and dramatically understate AM/FM radio audiences. In August 2024, Advertiser Perceptions, the leader in measuring brand and media agency sentiment, surveyed 303 agencies and advertisers with media budget decision-making responsibility. Marketers and media agencies were asked to estimate the audience shares of Spotify, Pandora, and AM/FM radio. The perceived shares were compared to the reality of audiences from Edison’s Q2 2024 “Share of Ear” study. Perceptions came nowhere close to actual audience shares. In the case of Spotify, the perceived audience share (25%) was six times larger than Spotify’s actual audience share (4%).”

COUNTERPOINT: Again, he’s arguing about only ad-supported media and not factoring in the entire audio landscape of paid subscribers who also listen to Spotify.

According to Spotify’s own numbers, only 13% of their accounts are ad-supported. If I did the math correctly, that means 87% of active Spotify accounts are paid. Spotify’s 2022 annual report showed 40.15% of its paid accounts are U.S.-based.

At the June 2023 meeting of the National Music Publishers Association, NMPA President/CEO David Israelite announced that Spotify had 44.4 million paying subscribers in the U.S. alone. He also revealed that Amazon Music had 29.3 million paid subscribers in the U.S.

Going further, Spotify announced in its Q2 2024 earnings report that it had 246 million paid users worldwide with 27% in North America. So that includes Canada and Mexico, but that nets out to 66.4 million paid users in North America. With 626 million Monthly Active Users worldwide, Spotify said 18% of them were in North America, so that’s 112.68 million active North American Spotify listeners every month. How much listening is that taking away from AM/FM radio?

—–

It’s entirely possible that these subscribers are paying for multiple services and that all these paid accounts don’t add up to a 1:1 ratio of paid subscriber to potential listener. But it’s hard not to believe that with tens of millions of paid subscribers to multiple platforms, Pandora, Spotify, Amazon Music, Apple Music and more are taking listeners away from over-the-air ad-supported AM/FM radio.

Overall, I get the need for Bouvard and Westwood One to do that apples-to-apples comparison of ad-supported media. But it’s a distorted picture. It shows an incomplete landscape of what’s actually capturing listeners’ ears. Having to split the adjectives down all the way to “ad-supported over-the-air AM/FM radio” is a big mouthful, especially if you have to slice and dice that far just to show radio’s advantage over other platforms.

Bottom line: Stop touting radio as being great because it reaches so many people. Taco Bell serves two billion customers per year, but I can’t imagine any of us would openly proclaim that Taco Bell serves quality food. Instead, focus on making the product great. You can’t just put up a transmitter in a city and expect people to flock to their radios simply because it’s there. Attracting customers means offering a quality service with compelling content that attracts people to listen. Make it can’t-miss content that makes people want to tune in, don’t just heave whatever at people and expect them to listen simply because it’s “ad-supported” and “over-the-air.”

And yes, that likely means investment from the top. Because, as is shown by that declining audience share mentioned in my first point, “cutting our way to success” doesn’t seem to be working out so far. Something needs to change, or else that 59% will be a high-water mark at some point.

A former air personality and industry journalist, Keith Berman worked at the late Radio & Records for several years, where he held a number of positions before being promoted to format editor. While at R&R, he also served as a writer and reporter, covering breaking news; authoring weekly columns, format roundups and features; and contributing heavily to Street Talk Daily. When R&R folded, he co-founded RAMP (Radio and Music Pros) and spent 3 years covering radio and record labels before taking a hiatus from the industry. His experiences also include time on-air at stations in Connecticut, Boston and Southern California. He can be reached at KeithBerman@gmail.com.